Business Credit Education

Business Credit Reports

In the same manner that you would view your personal credit report to check your financial history, that very information is being established and can be reviewed for your business. That’s because the minute you start a business, the credit bureaus begin to develop a business credit report on your company. They do this by searching public records and other financial data.

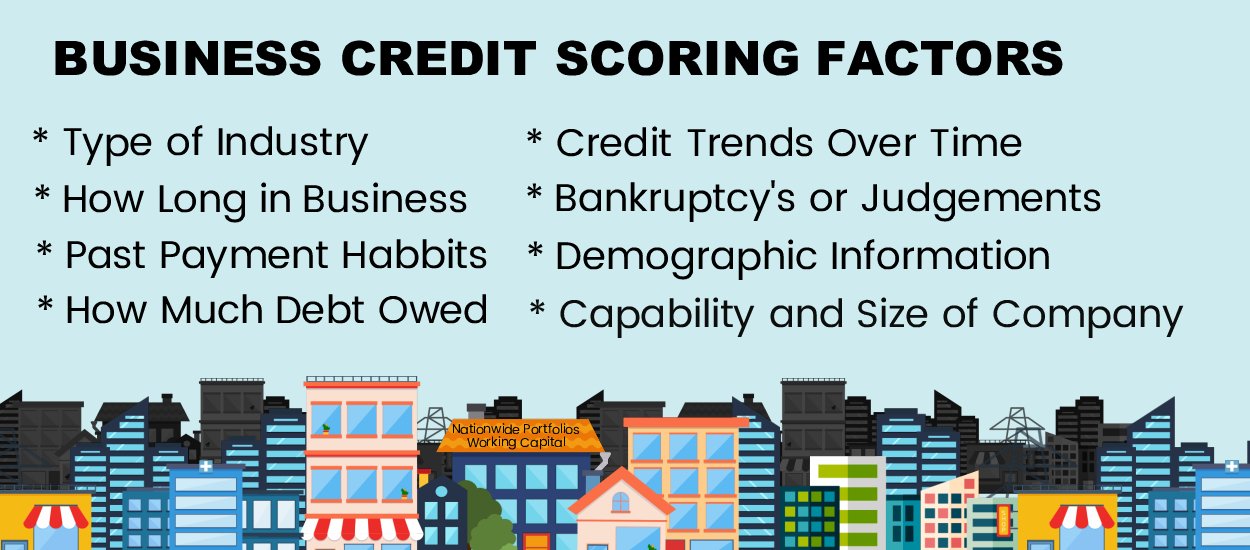

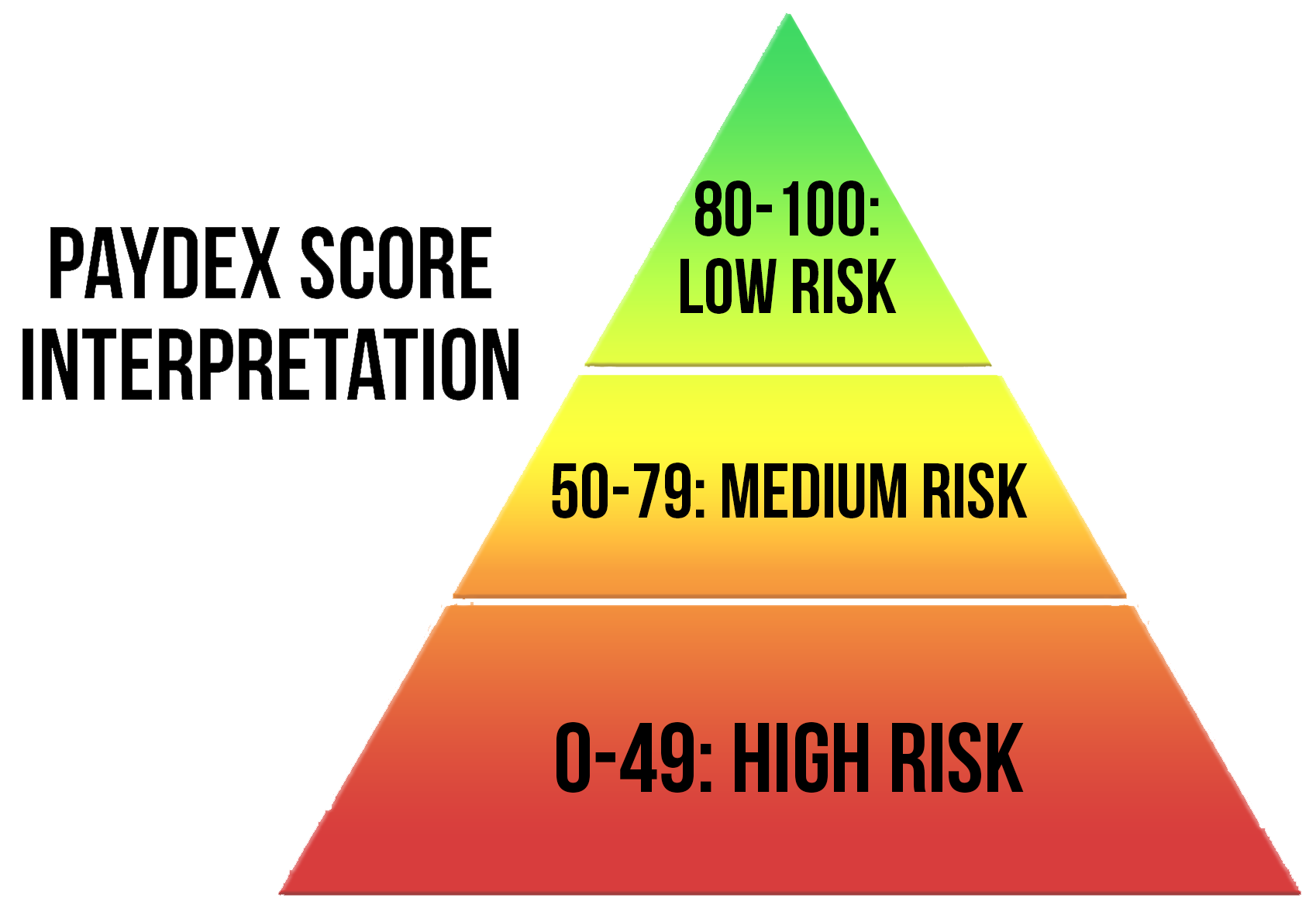

When you receive a business loan or line of credit — also known as trade credit or a trade line— information about your payment history is compiled by one of a few business credit reporting bureaus and providers, including Dun & Bradstreet, Experian, Equifax and FICO the information is then translated into a business credit score.

Doing the right things to build your business credit profile is one of the most important steps you can take as small business owner and aspiring brand. Doing so opens you / your business up to financing opportunities and business relationships that make it a lot easier for you to run and grow your business or brand. World Capital Credit educates you on how to leverage good business credit to capitalize your brand and finance your dream.

How business credit scores are used

Lenders and other creditors need a way of determining how well your business repays debts before they will approve you for financing. This is where establishing business credit allows you to leverage financial resources. Higher scores indicate to creditors that your business is more trustworthy, which improves the likelihood of obtaining the necessary financing to expand your business. Lenders can check your company’s business credit reports to get more detailed information about your business’s financial history. The rating can also allow you to access more credit than you could receive by applying for financing using just your personal scores. Attend a World Capital Credit webinar or Seminar to learn more about how to fund a music or film project by borrowing against your own company’s good business credit.

How can I improve my business credit score?

Register for a World Capital Credit webinar or seminar. Understanding how and when business credit scores are used can be confusing. However, keeping your scores strong is actually pretty simple. It’s a lot like taking care of your personal credit:

- Pay your business bills on-time or before they’re due.

- Open multiple credit accounts (business credit cards, trade lines, loans).

- Keep your credit utilization around 25% (don’t max out your credit lines).