Business Credit Education

Business Credit Reports

In the same manner that you would view your personal credit report to check your financial history, that very information is being established and can be reviewed for your business. That’s because the minute you start a business, the credit bureaus begin to develop a business credit report on your company. They do this by searching public records and other financial data.

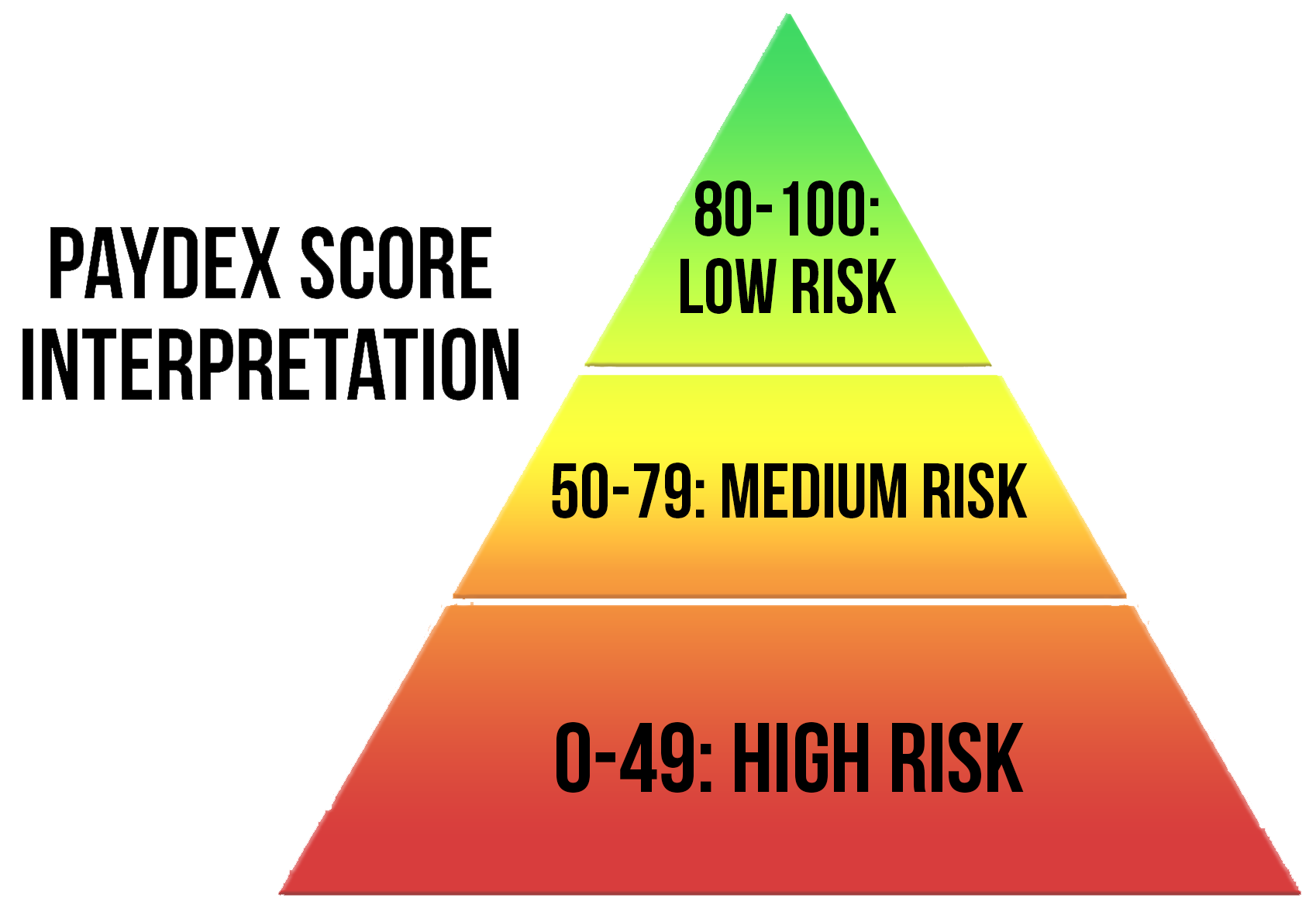

When you receive a business loan or line of credit — also known as trade credit or a trade line— information about your payment history is compiled by one of a few business credit reporting bureaus and providers, including Dun & Bradstreet, Experian, Equifax and FICO the information is then translated into a business credit score.

Doing the right things to build your business credit profile is one of the most important steps you can take as small business owner and aspiring brand. Doing so opens you / your business up to financing opportunities and business relationships that make it a lot easier for you to run and grow your business or brand. Musicnomics educates you on how to leverage good business credit to capitalize your brand and finance your dream.

Personal Credit Education

What is bad credit or a bad credit score?

A Lender uses your credit reports and your credit scores to make assumptions about your credit risk. The lower your credit score, the more risky they feel it is to lend you money, and the higher interest rates they will charge, if they decide on approving your loan request at all. Having a bad credit score means that lenders will consider you to be a high credit risk.

Increasingly, there are a number of other companies that will use your credit history and score to make determinations about you. Landlords, insurance companies, and potential employers, even state licensing associations, may all pull your credit history and review it. Bad credit can be a cause of you being denied an apartment, being charged higher insurance premiums, or even not getting employment or licensed in an industry.

Unfortunately, bad credit can often arise from errors or inaccuracies on your credit report. Many clients of ours have never seen their report, until they were told they had Bad credit and could not be approved. These labels are often times undeserved and a large amount of our clients come in underscored due to not being aware of or understanding of how and what was being listed on their personal credit reports.